Advertisement

Finding the right personal loan can be challenging, especially if you have fair credit. Many lenders offer loans, but not all of them provide good terms for people with less-than-perfect credit. The good news is that there are several reliable providers who specialize in helping individuals with fair credit get the loans they need. These lenders often offer reasonable interest rates, flexible repayment options, and fast approvals. This guide will help you explore the best personal loan providers tailored for people with fair credit.

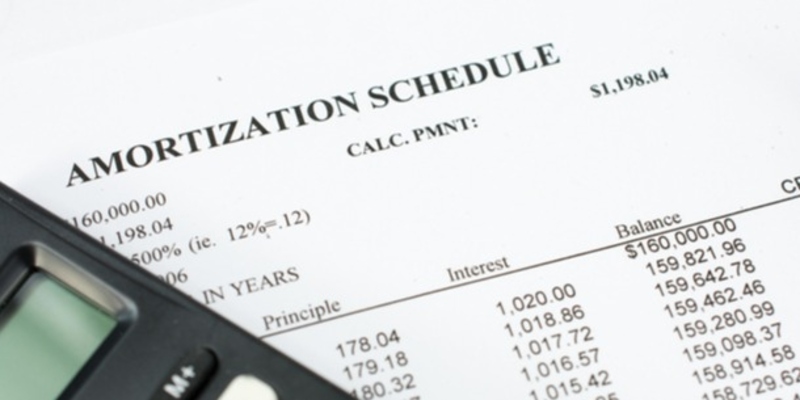

In general, people have a fair credit score if it is between 580 and 669. This score range suggest you can have few bad payment records such as a few times delayed or missed payments on your credit profile.

When searching for the best personal loan provider for fair credit, there are a few factors you should keep in mind:

Here are some of the best personal loan providers for people with fair credit:

Avant is a well-known lender that caters specifically to individuals with fair to good credit. They offer personal loans ranging from $2,000 to $35,000, making them a versatile choice for various financial needs. Avant's interest rates typically start at 9.95% APR, which is competitive for those in the fair credit range. The application process is straightforward, with a prequalification option that allows you to check your rates without affecting your credit score.

Avant offers flexible repayment terms ranging from 12 to 60 months, giving borrowers more control over their monthly payments. Keep in mind, however, that Avant may charge an origination fee of up to 4.75%, so it's important to factor this into the total cost of your loan.

LendingClub is a peer-to-peer lending platform that provides personal loans to borrowers, including those with fair credit. Loan amounts typically range from $1,000 to $40,000, with APRs starting at 8.05% for qualified borrowers. LendingClub is ideal for those seeking joint loan options, as they allow co-applicants to improve chances of approval and secure better terms.

Repayment terms are generally fixed between 36 to 60 months, offering consistency in monthly payments. However, like Avant, LendingClub may charge an origination fee that ranges from 3% to 6%. Despite this, the platform remains a solid option for individuals with fair credit, especially if you're looking for a collaborative borrowing experience.

Upstart redefines lending by leveraging artificial intelligence to evaluate creditworthiness beyond traditional credit scores. This innovative approach benefits borrowers with average credit who have a solid educational or professional background. Loan amounts range from $1,000 to $50,000, with competitive APRs starting at 6.50%. The streamlined online application process ensures quick approvals, with funding often available as soon as the next business day.

Although Upstart's origination fees can go up to 8%, their flexible underwriting process makes them a great option for individuals with fair credit looking to rebuild their financial standing.

If you prefer a more traditional lending experience, OneMain Financial may be the right personal loan provider for you. They offer secured and unsecured loans ranging from $1,500 to $20,000, making them a suitable option for smaller financial needs. APRs range from 18% to 35.99%, so they may not be the most affordable choice for those with fair credit. However, their flexible repayment options and ability to qualify with collateral can make them worth considering.

Upgrade is an online lender that offers personal loans of up to $50,000 with fixed rates starting at 6.98%. Their application process is entirely online, making it a convenient option for busy individuals. Upgrade also offers joint loans and allows co-signers, which can be helpful for those with fair credit looking to secure better rates and terms.

One downside of Upgrade is that they have a minimum credit score requirement of 620, so if your fair credit falls below this range, you may not qualify.

OppLoans specializes in providing personal loans to individuals with less-than-perfect credit. They offer installment loans ranging from $500 to $4,000 with APRs starting at 59%. While their interest rates may seem high, they are often lower than payday loan options and provide an opportunity for individuals with fair credit to improve their scores through on-time payments. OppLoans also has a quick application process and same-day funding options for eligible borrowers.

Best Egg provides personal loans from $2,000 to $35,000 with APRs starting at 5.99%. Their quick online application process can get you funded in as little as one business day after approval. Borrowers can choose flexible repayment terms of up to five years, offering more control over monthly payments. Keep in mind, though, that Best Egg charges an origination fee between 0.99% and 5.99%, so make sure to account for this in your loan costs.

Having fair credit does not mean you have to settle for high-interest rates or unfavorable loan terms. With these top personal loan providers, you can find a suitable option that fits your financial needs and helps you work towards improving your credit score. Remember to always compare rates and read the fine print before committing to any loan agreements. With responsible borrowing and timely repayments, you can build a stronger financial future for yourself. So, don't be discouraged by your fair credit - explore these options and take control of your finances today!

Advertisement

By Sid Leonard/Oct 09, 2024

By Darnell Malan/Apr 02, 2025

By Elena Davis/Oct 14, 2024

By Christin Shatzman/Oct 13, 2024

By Alison Perry/Feb 08, 2025

By Triston Martin/Mar 17, 2025

By Nancy Miller/Oct 21, 2024

By Aldrich Acheson/Feb 19, 2025

By Triston Martin/Feb 28, 2025

By Noa Ensign/Feb 19, 2025

By Susan Kelly/Dec 07, 2024

By Madison Evans/Feb 07, 2025