Advertisement

Mortgage amortization is a money-related process that holds an important position in home finance, directing borrowers on the systematic repayment of their house loans. When you amortize a mortgage, you slowly lower the loan balance over time through planned monthly payments which pay off both principal and interest. This arrangement gives borrowers stability in their payments and a definite schedule for when they will completely own their house. In this article, we want to discuss the functionality of mortgage amortization. We'll scrutinize how it influences the expense associated with a mortgage and provide insight for borrowers on understanding and handling this process efficiently.

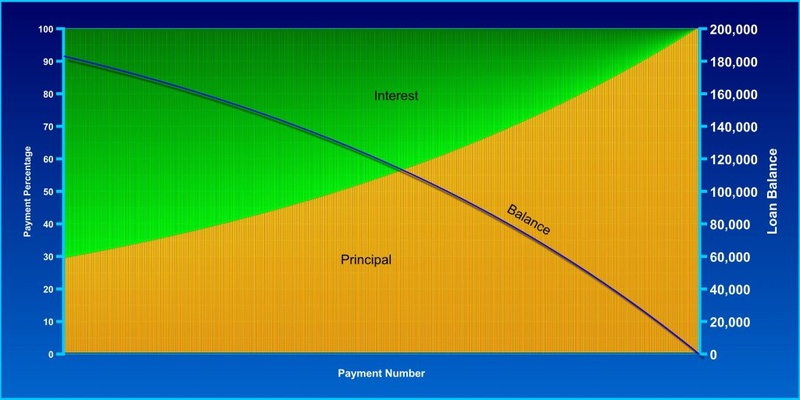

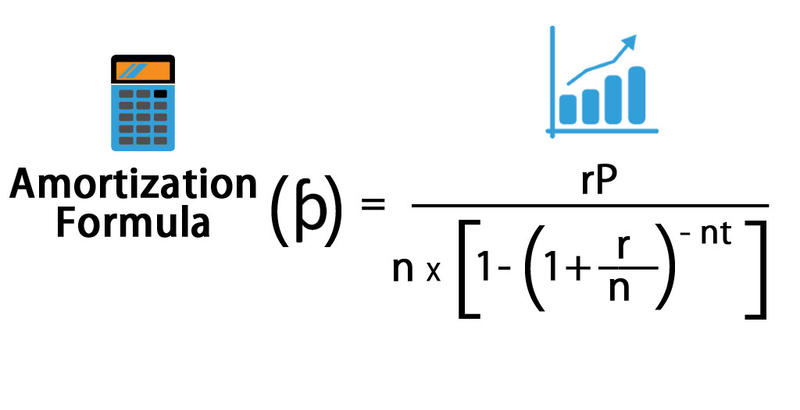

The concept of mortgage amortization is founded on a predetermined payment plan which determines the partitioning of each payment into loan principal and interest. In the early stage of a mortgage duration, most monthly payments are used to pay off the interest because, at that point, you still owe money. But as time goes by, more part of each payment starts going towards lowering your main debt amount or loan principal. This progressively reduces charged interests.

This change permits loaners to advance in paying off their main debt while lowering their interest expenses gradually. Comprehending how this method operates can aid individuals who have taken out loans, by showing the effects of each payment and helping them strategize for future financial conditions.

A schedule for mortgage amortization is a comprehensive table that illustrates the distribution of every monthly payment during the duration of the loan. This plan straightforwardly exhibits the allocation of each transaction between interest and main amounts. Supplying a division per month, this timetable assists individuals borrowing funds to predict their charges related to interests and monitor how they are advancing towards possessing their house completely.

A lot of people who borrow money look at this timetable to know how much interest they will have to pay for the entire duration of the loan. This is particularly important when thinking about choices such as redoing their loan or paying more toward the main amount borrowed.

The initial amount borrowed for a home purchase is called the loan principal, and interest refers to what it costs over time to borrow that principal. When making mortgage payments, they usually include both these elements, principal and interest, to slowly decrease the overall debt.

If you have an entirely amortizing loan, by completion of your mortgage term period, this means you've paid off all remaining balance. Those who borrow and know about both parties can make smart choices with their money. They could pay more on the main amount or look into shorter periods for loans to cut down on interest costs.

Interest rates greatly influence the price of a mortgage and its amortization structure. When the interest rate is high, more money from each payment goes to cover the interest initially which lessens the effect on the principal amount. On the contrary, if there's a lower interest rate it leads to a quicker reduction in principal sum enabling borrowers to repay their mortgage earlier than the scheduled time.

Mortgages with fixed rates give stability by having regular payments, whereas adjustable-rate mortgages (ARMs) can have variable interest rates which may affect the schedule of amortization and overall paid interest.

Mortgage amortization provides a predictable and straightforward way to own a home, bringing relaxation for borrowers as they're aware of the time they will be free from debt. For several people, this process also paves the path to saving money on interest by making extra payments toward their main loan amount.

By comprehending how mortgage amortization operates, individuals taking loans can efficiently handle their paybacks, contemplate options regarding refinancing and, eventually diminish costs associated with their loans. A lot of individuals who borrow and understand the idea of amortization feel confident to make choices that match their future financial objectives.

People who own houses can take advantage of plans to improve their mortgage amortization, for example by making more payments to lower the main balance. These extra payments decrease the loan's period and interest paid in the long run. Changing your existing high rate to a low one or reducing the term like opting for years instead of 30 years could also streamline this amortization procedure and help save money over time.

Knowing these strategies assists in getting the most from their mortgage and lessens the monetary strain of owning a home, making their path towards complete homeownership cheaper and easier.

So in short, mortgage amortization not only explains a payment system but also gives homeowners methods for obtaining more financial liberty by smartly and effectively handling their mortgage payments.

Advertisement

By Martina Wlison/Oct 12, 2024

By Madison Evans/Nov 14, 2024

By Nancy Miller/Oct 21, 2024

By Gabrielle Bennett /Oct 14, 2024

By Darnell Malan/Dec 07, 2024

By Elva Flynn/Mar 17, 2025

By Noa Ensign/Feb 19, 2025

By Tessa Rodriguez/Oct 13, 2024

By Maurice Oliver/Nov 22, 2024

By Vicky Louisa/Dec 07, 2024

By Tessa Rodriguez/Dec 16, 2024

By Martina Wlison/Nov 22, 2024