Advertisement

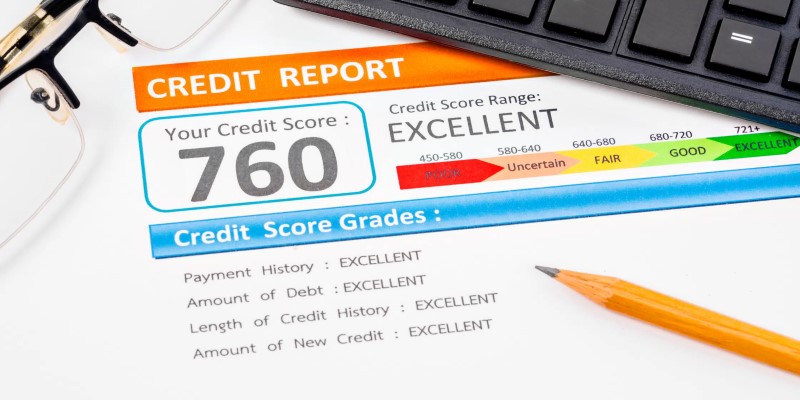

Achieving a 760 credit score is a major accomplishment in personal finance. This score can unlock numerous opportunities, including better loan terms and access to premium credit cards. If you're curious about the benefits of having a 760 credit score, you'll be pleased to know that it marks you as a financially responsible borrower, providing advantages in various financial areas.

In this article, we will explore how a 760 credit score influences your ability to secure loans, credit cards, and other financial products, as well as tips on how to make the most of these benefits. Whether you're planning to purchase a home, finance a vehicle, or take advantage of top credit card offers, this score places you in a highly favorable position.

A credit score of 760 falls into the "good" range of the FICO score model, which runs from 300 to 850. This score reflects that you have a strong credit history and are likely to be approved for credit at competitive rates. It puts you above the 700-point threshold, which is generally considered the cut-off for good credit. With a score of 760, you are generally viewed as a low-risk borrower by lenders, which greatly improves the prospects of getting loans and credit at favorable terms.

While the score is undoubtedly phenomenal, it is just as crucial to maintain the same score over time. A 760 credit score means you've reliably proven your ability to pay bills on time and otherwise use credit responsibly. You should notice that lenders have recognized low credit utilization, a good payment history, and limited recent inquiries about credit in determining your overall credit quality. However, maintaining such a score requires far more than just paying the bill when it's due. It is all about managing your debt, low credit inquiries, and maintaining the right mix of credit.

Perhaps one of the largest advantages of a 760 credit score is better loan terms, particularly when applying for significant financial products like mortgages or auto loans. With a score this high, you can probably qualify for the lowest interest rates, which will save you thousands of dollars over the life of a loan. Lenders view you as a low-risk borrower, so they're more likely to offer you favorable terms. For instance, on a mortgage, a 760 credit score could help you secure a lower interest rate, which would then help your monthly payment decrease and overall interest paid over time.

A 760 credit score can give you a bit of an edge when applying for auto loans. That would mean financing your vehicle at a lower rate, which makes the car more affordable in the long run. The same is true whether it is a home or a vehicle: a 760 credit score gives you the leverage to negotiate terms that work well for you. Having such a score, you can go confidently to the lenders and secure the best possible interest rates in the market.

Another significant benefit of a 760 credit score is the ability to qualify for premium credit cards. These cards typically offer perks such as higher credit limits, cash-back rewards, travel points, and other benefits designed for financially responsible cardholders. Some examples of these cards include those offered by major banks or credit card companies like American Express, Chase, or Capital One, which offer valuable rewards programs, concierge services, and exclusive offers for customers with high credit scores.

Credit cards designed for individuals with a 760 credit score often come with lower interest rates as well, which means if you carry a balance, you'll be paying less in interest compared to individuals with lower scores. Additionally, these cards often have sign-up bonuses, travel benefits, and other incentives that can help you maximize the value you get from spending on your credit card. The ability to earn rewards on everyday purchases can make a significant difference in your finances, especially if you're able to pay off your balance each month to avoid interest charges.

Beyond loans and credit cards, a 760 credit score opens up a host of other financial advantages. For instance, you may be eligible for lower insurance premiums, as many insurance companies use credit scores to determine rates. With a high score, youre more likely to receive a better rate on auto and homeowners insurance, which can result in significant savings over time.

Some employers also review credit scores during the hiring process, particularly for positions that involve financial duties. A 760 credit score signals to potential employers that you are financially responsible, which could give you an edge in securing job opportunities. On top of that, this score may make you eligible for more favorable rental agreements, as landlords often run credit checks to assess a tenant's ability to manage finances.

A high credit score also increases your likelihood of qualifying for personal loans at favorable rates. Personal loans can be used for various purposes, including debt consolidation, home improvement projects, or covering unexpected expenses. With a score of 760, you are seen as a reliable borrower, which means youll have more options for borrowing money at attractive rates.

A 760 credit score offers a wealth of opportunities, providing you with access to the best financial products and terms available. From securing lower interest rates on mortgages and car loans to qualifying for premium credit cards and enjoying other perks like reduced insurance premiums, this score positions you to make the most of your financial decisions. Its a powerful tool that can help you save money, achieve financial goals, and open doors to opportunities that might otherwise be out of reach. To maintain this score, continue managing your credit wiselykeep your debt-to-income ratio in check, make payments on time, and avoid accumulating too much debt.

Advertisement

By Martina Wlison/Oct 12, 2024

By Tessa Rodriguez/Oct 13, 2024

By Vicky Louisa/Dec 07, 2024

By Christin Shatzman/Jan 12, 2025

By Nancy Miller/Oct 24, 2024

By Sean William/Dec 18, 2024

By Noa Ensign/Feb 19, 2025

By Madison Evans/Mar 18, 2025

By Madison Evans/Feb 07, 2025

By Triston Martin/Oct 09, 2024

By Martina Wlison/Nov 22, 2024

By Elva Flynn/Oct 09, 2024